Aumni have just released their second Venture Beacon report which this time covers the first half of 2023 (available for free here). In this report Aumni, a company that offers investment analytics software to the venture capital industry and which was acquired by JP Morgan earlier this year, provides a great data-backed overview of what is happening in the market*.

There is much to digest in the most recent report but these are my three highlights:

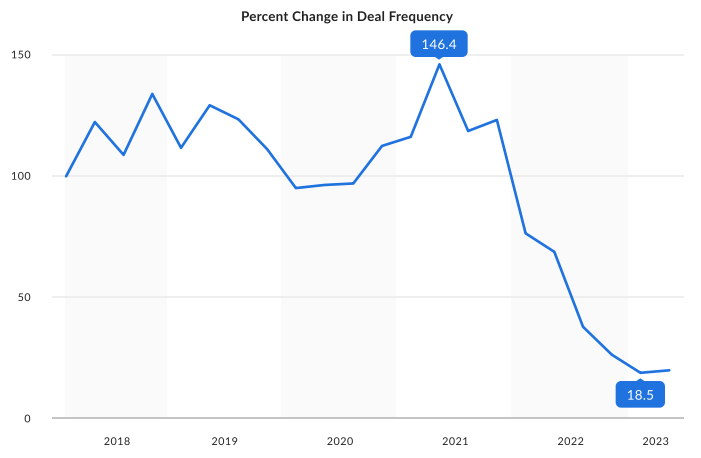

1. The drastic decrease in deals (down 40% from H2 of 2022 and 85% from the peak of 2021). This is accompanied by a decline in the amount of capital raised, which has gone down by 24% as well as a slowdown in the velocity of deals. Essentially, there is less money and those who have it are being more judicious in how they spend it.

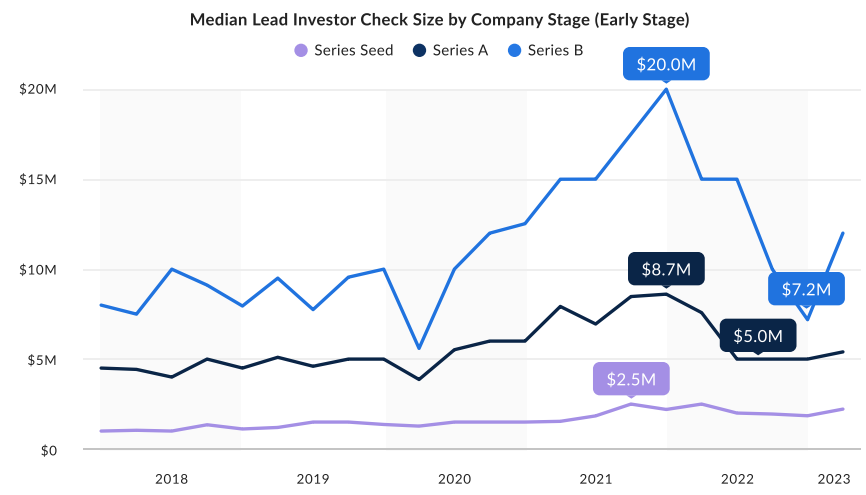

2. The lack of available cash is forcing startups to raise capital at drastically reduced valuations particularly in later series (Series A: 42% decrease. Series B & C: 60%+ decrease. Series D: 75%). Indeed, there was even an increase in down rounds.

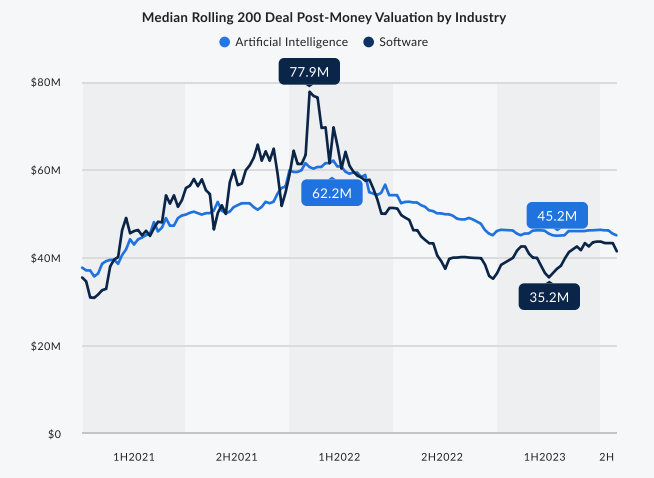

3. AI-centred startups have managed to better retain value when compared to other software startups.

None of which is surprising but merely confirmation of what everyone in the space has been feeling. What is good from such a report is that it provides no hiding places; it is hard to debate against data. In turn this allows startups to better prepare themselves.

The best tactic is to conserve cash as much as possible and wait for a better time to raise. If that raise cannot be postponed then you have to be sharper in your pitches (highlighting the areas that investors are looking for such as growth) whilst tempering internal expectations. There’s nothing to be gained in stressing that a similar startup raised at a particular valuation two years back; the market is wholly different now.

Alternatively, try to portray your startup as being an AI-based one to get a better valuation!

* All data is focused on the US yet the general trends are also being experienced in the rest of the world.

Interesting data. The reality as I see it, "revenue is everything". The only thing you can use to support valuations in a stubborn investment market. I caution against the "claim AI" tag, there are already too many projects attaching themselves to AI which make no sense. It will create problems in future rounds.

AI startups are raising but for some valuations are being slashed so all is not well in that sector. A "quality shakeout" is starting.

For the rest of us, hang in there, adopt a long game and keep everything as lean as possible. Good luck